Tax Collection

Transfer Tax Payment

- Certificate Authorizing Registration (CAR) or Proof of Payment (Bank Receipt)

- Deed of Sale / Donation / Extrajudicial

- Tax Clearance from Municipal or Provincial Treasurer’s Office

- Tax Declaration (Certified Xerox or Owner’s Copy)

- Transfer Certificate of Title

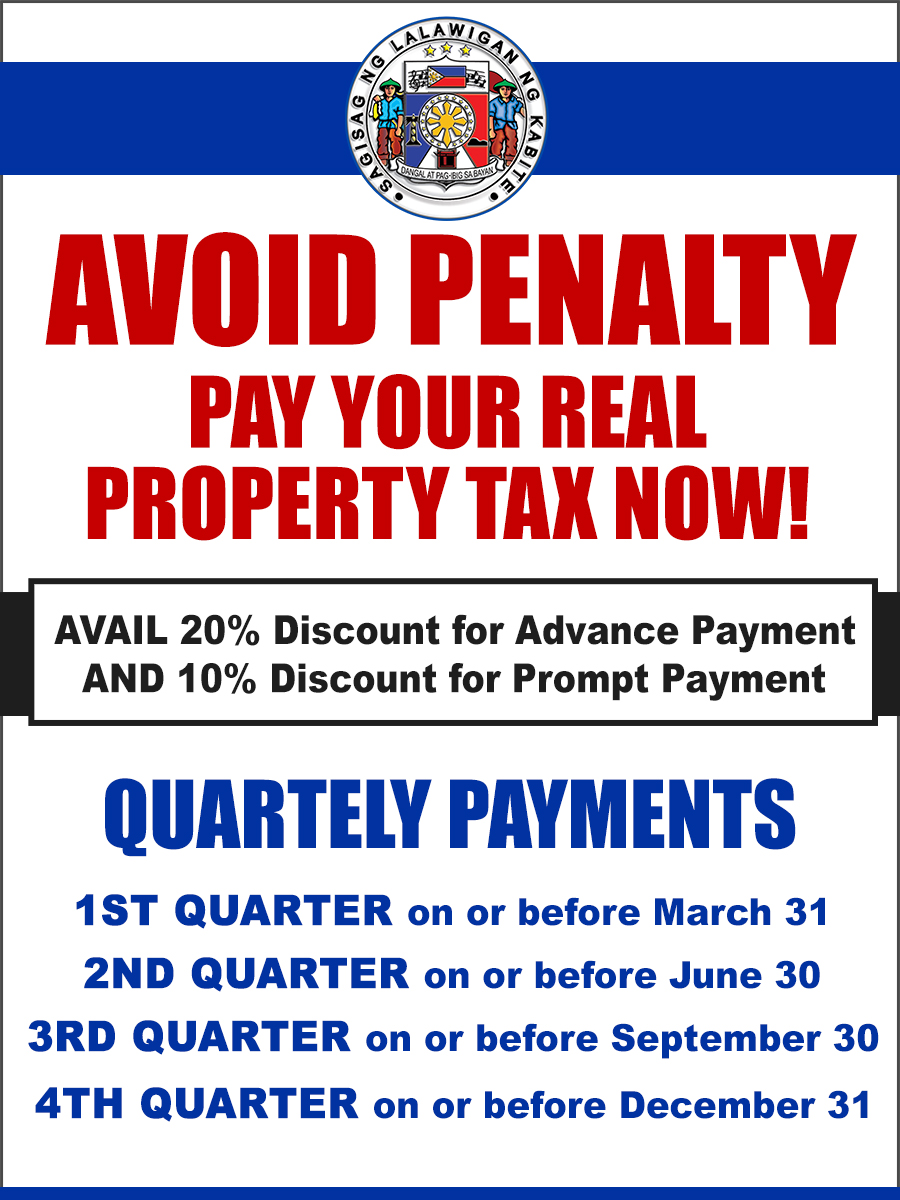

Real Property Payment

- Copy of previous official receipt

- Certified xerox or owner’s copy of tax declaration

RPT Tax Clearance

- Original Copy of Official Receipt

- Valid ID’s (Driver’s License, GSIS & SSS UMID ID, Passport, COMELEC ID, Senior Citizen’s ID, Postal ID)

- Special Power of Attorney (in case of representative)

- Municipal Tax Clearance

Quarry Resource Tax

- Order of Payment from P.E.O

- Official Receipt of Last Payment

Idle Land Tax

- Tax Declaration

Amusement Tax

- Mayor’s Permit

- Business Permit

- Government Permit

- Annual Gross Receipts Certified by Accountant

Franchise Tax

- Annual Gross Receipts Certified by Accountant

Annual Fixed Tax on Delivery Trucks or Vans

- Official Receipt of Car Registration / Certificate of Registration

News and Events

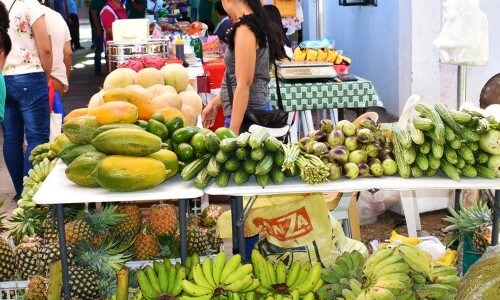

- Agricultural Services

- Cooperative, Livelihood & Entrepreneurship Development

- Education

- Environment

- Health Care

- Housing

- Job Opportunities

- Population

- Social Welfare

- Tax Collection

- Veterinary

Frontline Services:

- Distribution of palay/corn, seeds and fertilizers

- Distribution of Sexually and Asexually Propagated Seedlings, Vegetables Seeds and Fingerlings

- Technical Assistance on Crop Production (Rice, Corn, HVCCI & Fisheries)

- Promotion of Urban Agriculture / Gulayan sa Paaralan / Gulayan ng Masa / Organic Fertilizer Production / Mushroom Production / Urban Aquaculture

- Promotion of Livelihood Trainings

- Assistance for Income Generating Project (IGP) for Farmers, Homemakers, 4-H Club Member, NGOs

- Validation of Agri-Infra Projects

- Pest clinic for Pest Control

- Soil Analysis for agricultural use

- Access to Farm Machineries / Equipment and other Office Facilities

- Farmers Information and Technology Services (FITS)

The Provincial Cooperative, Livelihood and Entrepreneurial Development Office is mandated to implement programs and services in the promotion and development of cooperatives and micro, small and medium enterprise (MSMEs) and in encouraging enterprising activities in the province in the consonance with national development thrusts, legislations and policies.

"Bringing people and resources together towards sustainable economic development"Cavite Cooperative Development Center (CaCoDeC)

Capitol Road,Trece Martires City, Cavite

Telefax: (046) 419-1273; 419-0521

The Cavite Computer Center (CCC) is an extension office of the Provincial Governor, serves as a dynamic arm in providing computer literacy program for the people of Cavite Province especially for Out-of-School-Youth (OSY) cooperation with Department of Education Non Formal Studies. It started late December, 1999 spearhead by the Office of the Provincial Governor in collaboration with the Department of Education Culture and Sports Non-Formal Studies. As of now, our training applicants have gone up by the thousand comprising of OSY, government employees, NGO`s, individuals and even professionals who are seeking to enhance their computer skills. The success of CCC was brought about by our dedication and commitment in offering quality and significant free computer training.

Contact Information

MS. ANABELLE L. CAYABYAB, MPA

Provincial Government – Environment and Natural Resources Officer

Provincial Government-Environment and Natural Resources Office

Tel. No. (046) 419-0916

e-mail: pgenro_cavite@yahoo.com

Contact Information

Provincial Health Office

General Emilio Aguinaldo Hospital

Barangay Luciano, Trece Martires City

(046) 419-0123

pho@cavite.gov.ph

Contact Information

MA. KAREN B. CAMAÑAG-TUPAS

OIC -PROVINCIAL HOUSING DEVELOPMENT & MANAGEMENT OFFICE

YAHOO ACCOUNT: cavite_housing@yahoo.com

FB ACCOUNT: PhdmoCavite2017@yahoo.com

CONTACT NO.: (046) 419-2689

Contact Information

Ms. Lorena B. Cron

Provincial Population Officer

Provincial Capitol Building

Provincial Capitol Compound

Trece Martires City

Tel. No. (046) 419-2784

e-mail: population@cavite.gov.ph

The Provincial Social Welfare and Development Office (PSWDO)’s programs and services are geared towards promoting the rights and welfare of the poor, and marginalized for an improved quality of life.

For the past years, the PSWDO’s roles and functions have expanded in accordance with the Local Government Code, which was implemented in 1992. It directed the functions and operations of the Office as direct service provider and technical service provider.

- Transfer Tax Payment

- Real Property Payment

- Real Property Tax Clearance

- Quarry Resource Tax

- Idle Land Tax

- Amusement Tax

- Franchise Tax

- Annual Fixed Tax on Delivery Trucks or Vans

- Animal Health Program

- Livestock Production, Demonstration and Development Program

- Livestock Upgrading Program

- Regulatory Services

- Meat Inspection

- Livestock Research Program

- Dairy Development Program

- Capability Building